Apr compounded monthly

The APR includes fees in. For example if the amount owed is 1500 the payment due date is April 1 the agency does not pay until June 15 and the applicable interest rate is 6 interest.

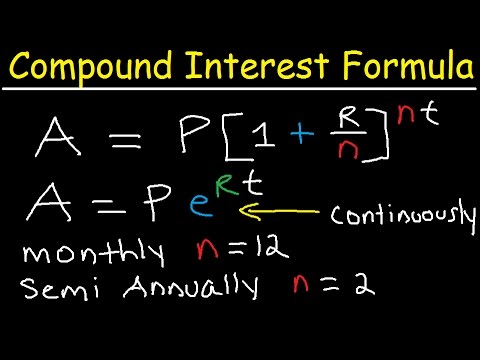

How To Calculate Interest Compounding For Exponential Growth

Interest is charged monthly not annually and may be compounded daily or monthly.

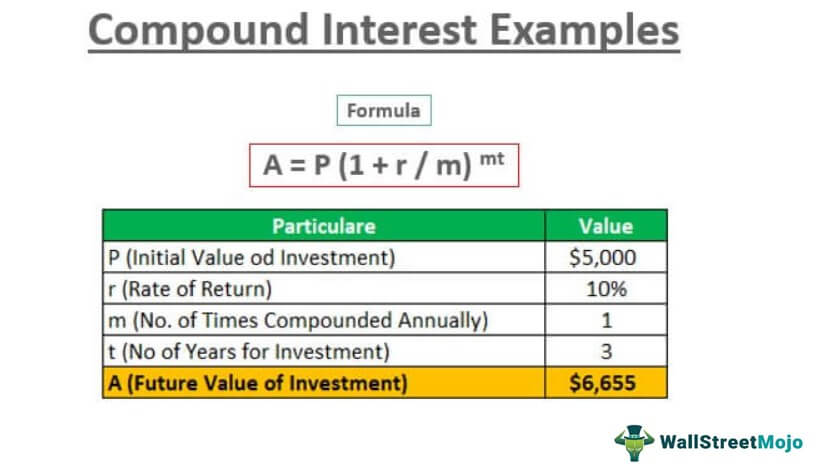

. Initial interest rate and the APR on a 5-year variable closed mortgage compounded monthly. A basic savings account for example might compound interest. In your compound interest formula this value is represented by an n In the case of an investment interest would be compounded until the end of the deposit term or until you withdrew your investment.

Estimate the total future value of an initial investment or principal of a bank deposit and a compound interest rate. The traditional period for amortization of a mortgage the time to pay it off is 25 years. Include additions contributions to the initial deposit or investment for a more detailed calculation.

Example Effective Annual Interest Rate Calculation. See how much you can save in 5 10 15 25 etc. Years at a given interest.

Additional fees may. Mortgages dont do that because the total amount of interest due is already calculated beforehand and can be displayed via an mortgage amortization schedule. Interest rate and approval based on risk profile.

Key points to understand. What does APR mean on a credit card. Further you want to know what your return will be in 5.

Daily monthly quarterly or annually. However in most loan situations it is compounded monthly. In this calculator the monthly payment is calculated by the following formula where r R1200.

Loan Amount The original principal on a new loan or remaining principal on a current loan. Interest rate of 1 compounded yearly APY 1. Lets say you borrow 100 at 10 APR.

Turn your cold assets into hot profit instantly by depositing crypto in your YouHodler wallet. But this is done in periods of five years at a time though it is possible to pay the mortgage down in a shorter period just not longer. For residential first mortgages only.

Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month. Over the same time period the average US home price increased from 19300 to 383900 for a 548 compounded annual rate of return. In reality though youll probably pay more than 10.

The first part of the equation calculates compounded monthly interest. Compounding The frequency or number of. APR Calculator UK helps you to calculate the annual percentage rate APR on your loans.

This is a variable rate product which will fluctuate with the Coast Capital Savings prime rate. The size of homes also increased significantly. Your APR refers to one year.

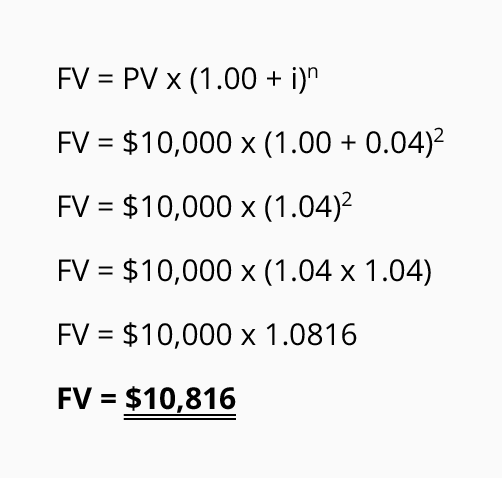

Daily compounding yields a higher interest of 8360 which is slightly higher than the interest at monthly rates of 8260. For example a 300000 mortgage set at 4 on a 30-year fixed mortgage will have total interest due of 215610 over the life of the loan. Annual Percentage Yield - APY.

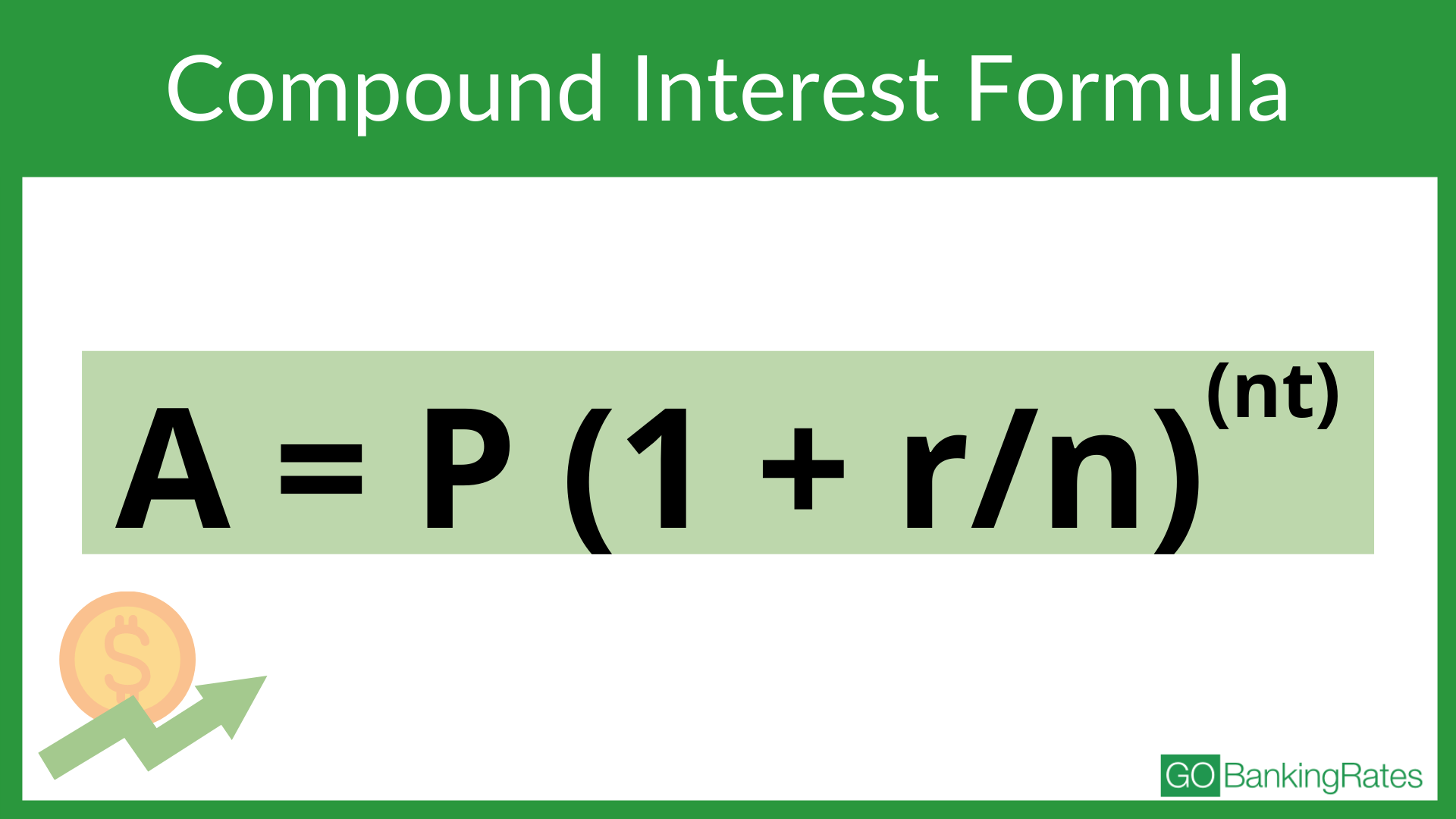

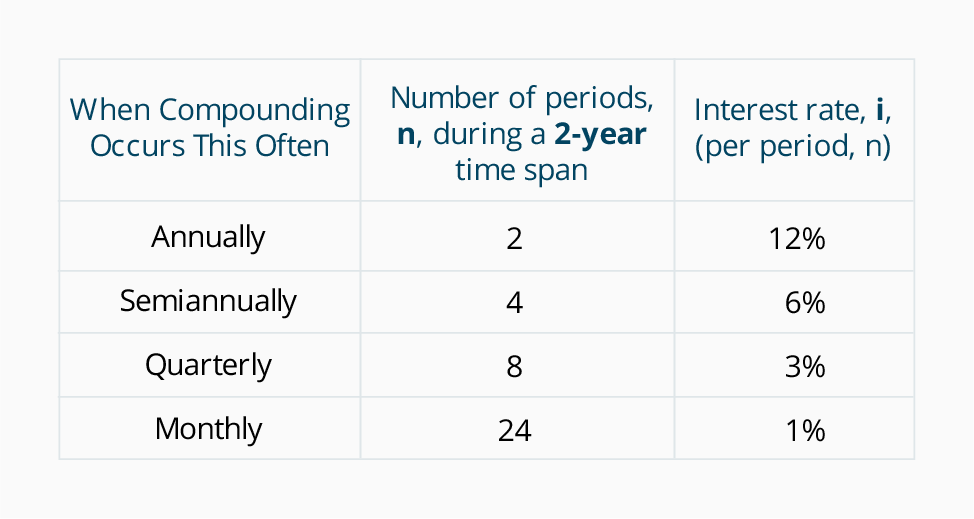

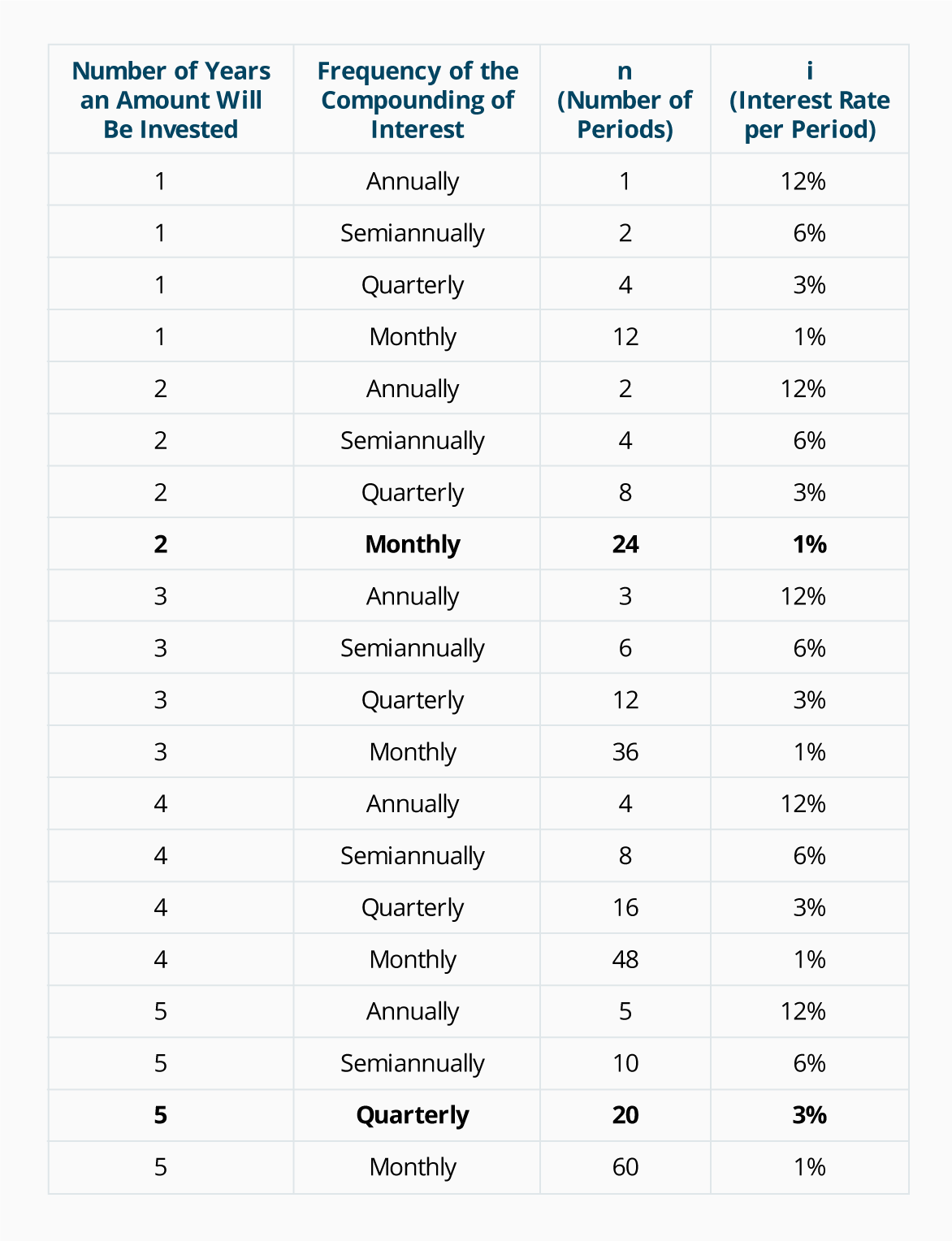

APY is calculated by. The interest can be compounded annually semiannually quarterly monthly or daily. For instance if your interest is compounded as is the case for long-term loans such as mortgages and student loans calculating APR will not be specific.

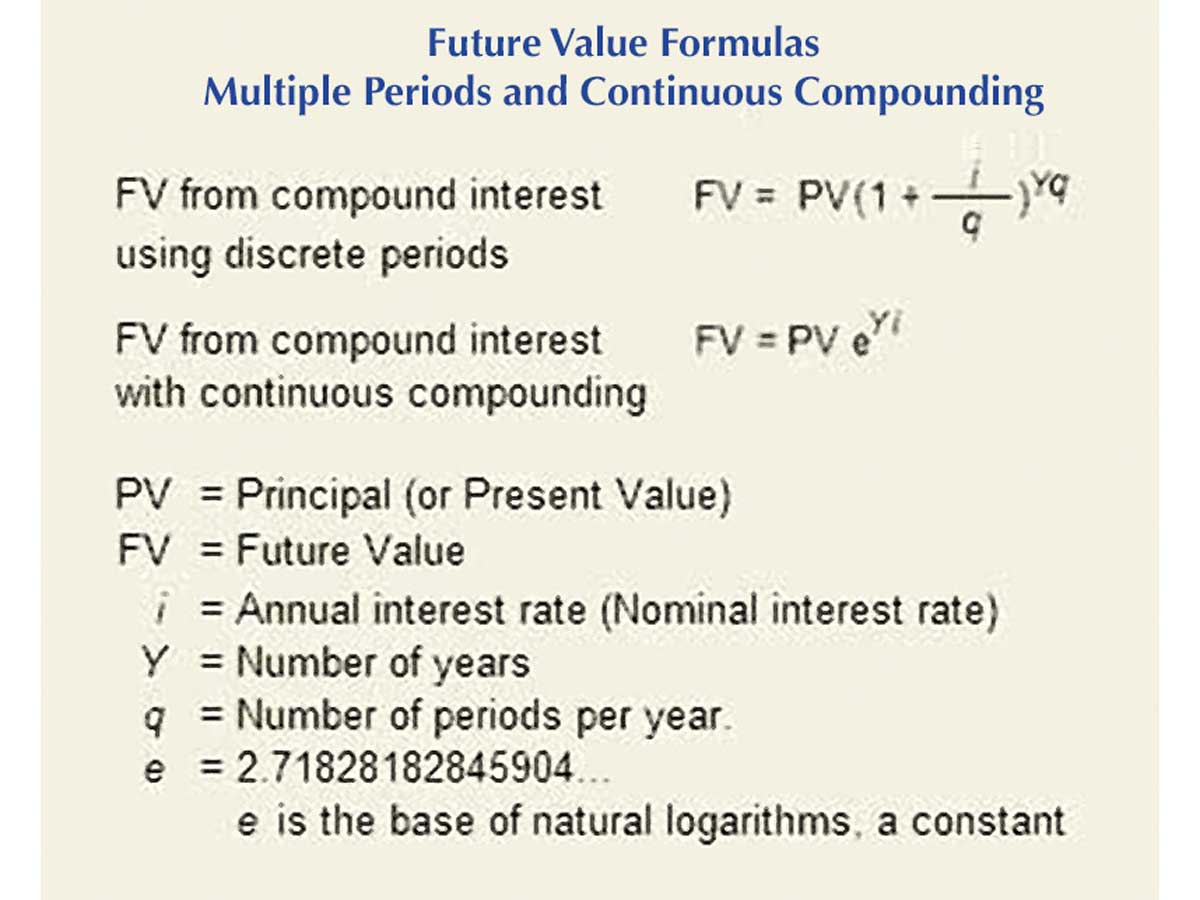

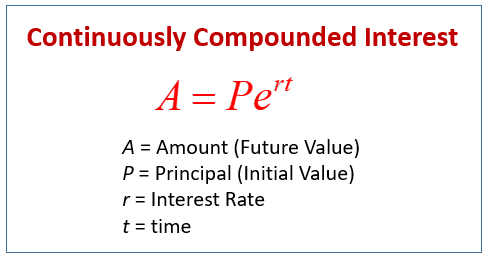

It is an extreme case of compounding since most interest is compounded on a monthly quarterly or semiannual. If you are getting interest compounded quarterly on your investment enter 7 and 4 and 1. Times per year that interest will be compounded.

In 1973 the average new home was 1660 square feet and the median new house was 1525 square feet. All calculations assume interest is compounded on monthly basis. Understanding APR.

And when it comes to credit cards the APR and interest rate may be the same. Calculating your monthly APR begins by calculating your total APR. Earn Bitcoin BTC Pax Gold PAXG USD Coin USDC True USD TUSD and more.

Broadly speaking your annual percentage rate APR is the price you pay to borrow money. Now the only thing you have to remember is that the higher the APY value is the better the offer. APY can sometimes be called EAPR meaning effective annual percentage rate or EAR referring to the effective annual rate.

See the Basic APR Calculator for simple APR calculations. APR is an annualized rate. Because even though APR is expressed in terms of years credit card issuers often charge interest on a monthly basis.

APR is a rough snapshot of the interest you would pay annually but the real percentage is going to be higher due to compound interest charges. Continuous compounding is the mathematical limit that compound interest can reach. To find our monthly APR simply divide your total APR by.

Things can still get slightly confusing though. Multiply the result from step 4 by 100 to convert the monthly rate from a decimal to a percentage. The longer the amortization period the smaller the monthly payments will be but the more the loan will cost in total.

Interest rate of 05 compounded daily APY 0501. Thus at the equivalent rate APR appears lower than the APY assuming positive rates. Over the course of one year youll pay 10 in interest because 10 is 10 of 100.

Length of Time in Years. Crypto interest earnings are deposited directly into your wallet every week. Finishing the example you would multiply 100 by 0001978332 to find the monthly interest rate to be 01978332 percent.

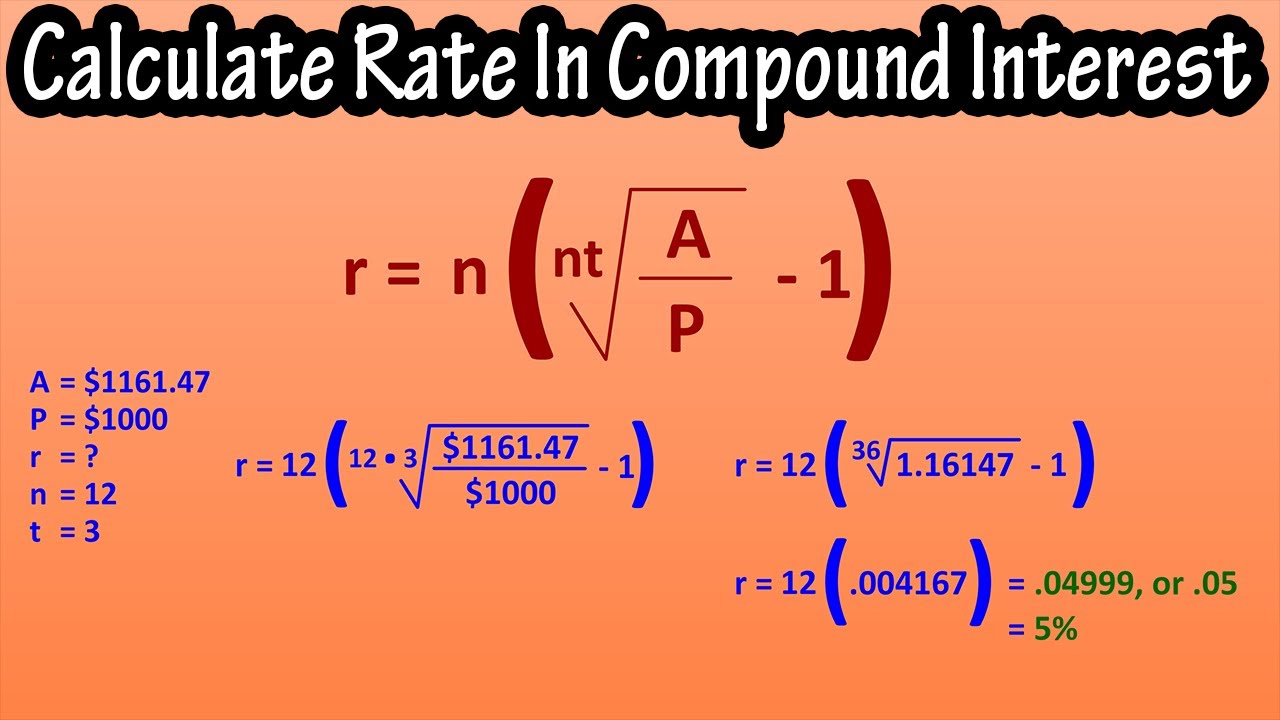

Find the Interest Rate. By calculating APY you can see that the first exemplary offer pays the most. Also the monthly rate yields an interest of 83 which is slightly higher than the interest produced by quarterly rates at 8240.

The second part of the equation calculates simple interest on any additional days beyond the number of months. Those terms have formal legal definitions in. APR typical APR advanced Resources.

The annual percentage yield APY is the effective annual rate of return taking into account the effect of compounding interest. We know this beforehand because mortgages are amortized. Interest Rate The annual interest rate or stated rate on the loan.

You receive the interest payments on a set schedule. Interest rate of 07 compounded quarterly APY 0702. The main difference between APY and APR is that the former considers yearly compounded interest while APR always means a monthly period.

Suppose you have an investment account with a Stated Rate of 7 compounded monthly then the Effective Annual Interest Rate will be about 723. For example if your mortgage compounds interest monthly it would be compounded 12 times in a year. The term annual percentage rate of charge APR corresponding sometimes to a nominal APR and sometimes to an effective APR EAPR is the interest rate for a whole year annualized rather than just a monthly feerate as applied on a loan mortgage loan credit card etcIt is a finance charge expressed as an annual rate.

In other words it describes how much interest youll pay if you borrow for one full year. How do you calculate monthly APR. If fees or charges apply the APR could increase.

Compound Interest Definition Formula How It S Calculated

Mathematics Of Compounding Accountingcoach

Answered You Have Just Sold Your House For Mortgage Payoff Selling Your House Payoff

Openalgebra Com Interest Problems

How Can I Calculate Compounding Interest On A Loan In Excel

What Is Compound Interest A Guide To Making It Work For You Not Against You Gobankingrates

What Is Monthly Compound Interest Formula Examples

Word Problems Compound Interest Video Lessons Examples And Solutions

Present Value Frequency Of Compounding Accountingcoach

How To Calculate The Annual Interest Rate Compounded Monthly Quora

How To Solve For Or Calculate Rate In Compound Interest Formula For Rate In Compound Interest Youtube

Cost Of Borrowing Compounded Monthly Find Present Value For Monthly 131 Payment For 6 Years Youtube

:max_bytes(150000):strip_icc()/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

Compound Interest Explained With Calculations And Examples

Compound Interest Examples Annually Monthly Quarterly

Mathematics Of Compounding Accountingcoach

Dp Maths Compound Interest 10 Apr 17 Subscribe Us Www Youtube Com C Mahendraguruvideos Join Us Facebook Math Study Materials Compound Interest

Compound Interest Formula Explained Investment Monthly Continuously Word Problems Algebra Youtube