27+ option straddle calculator

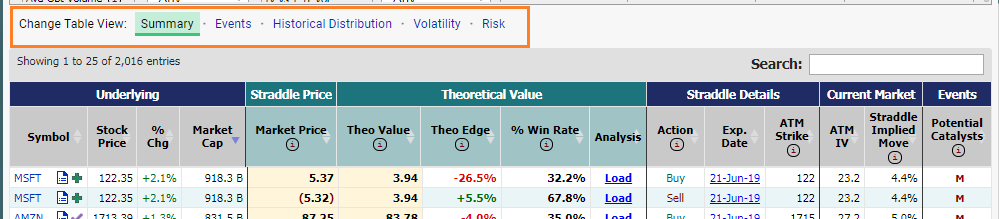

Of course the earnings report is most likely a big factor in that. Web At-the-Money Options Straddle Screener.

How Effective Is The Long Straddle Option Strategy Are There Better Ways To Hedge When Trading Options Quora

Put option makes money This is a scenario where the gain in the put option not only offsets the.

. Reposition any trade in realtime. Enter the underlying asset price and risk free rate. Watch Our Free Webinars Today.

The lower range can be calculated by taking the stock price of. The implied move for this expiration using the 20-Day Historical Volatility. Enter the maturity in days of the strategy.

Web A powerful options calculator and visualizer. Ad Use our free ROAS calculator to calculate your return on ad spend. 102 Long Straddle.

Web Options have a premium value that can allow you to capitalize on this approach. Web Straddle Implied. Enter the maturity in days of the.

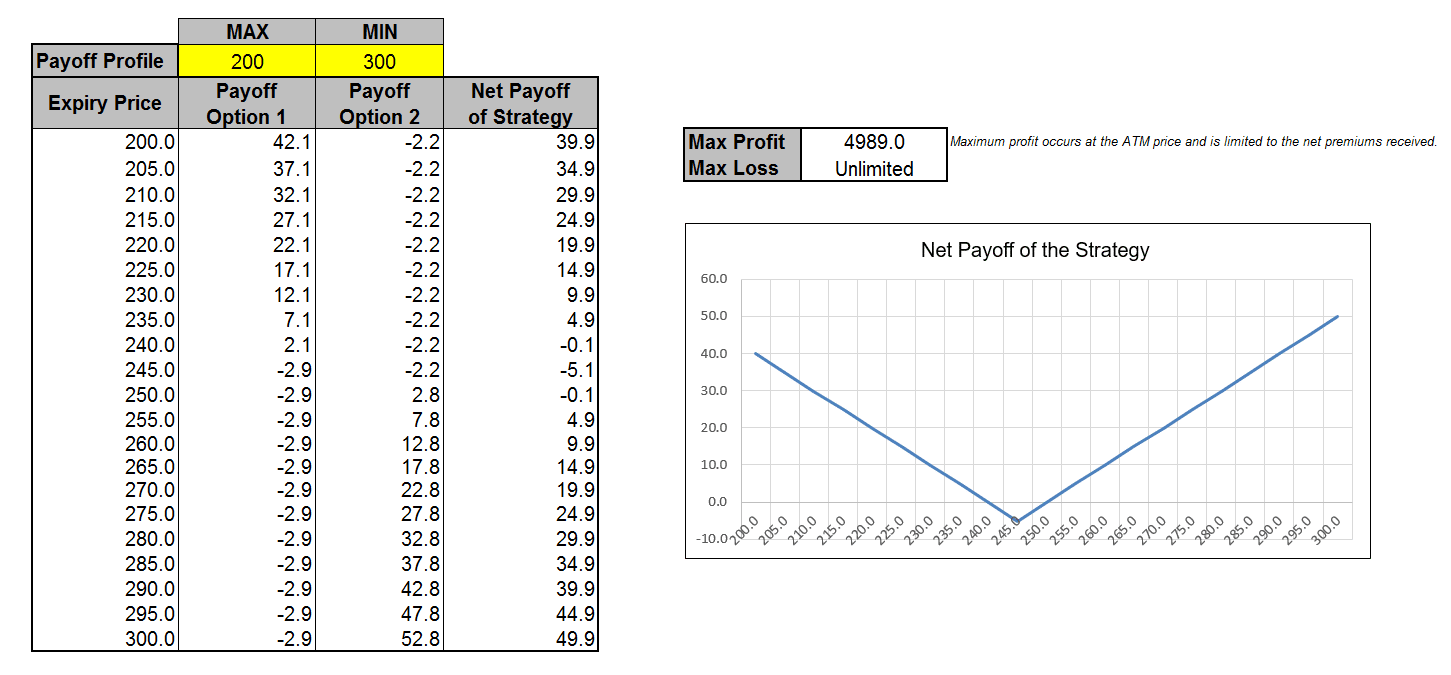

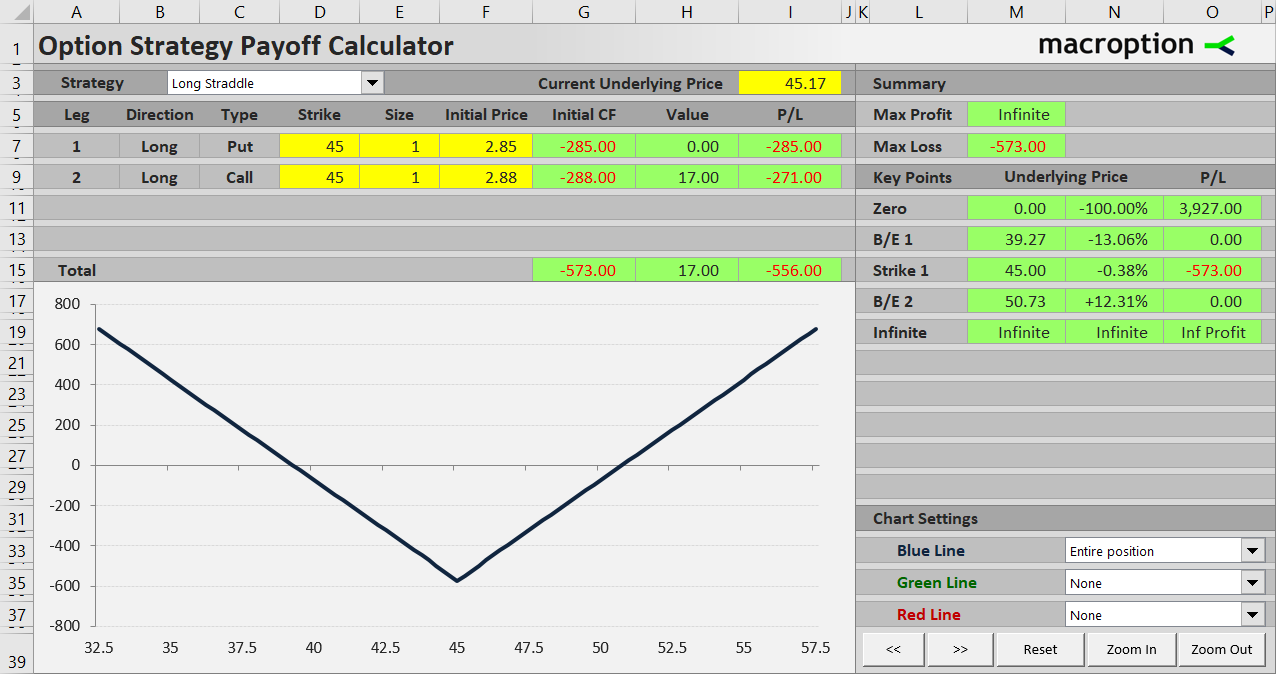

Select your option strategy type Long Straddle or Short Straddle Step 2. Web A long straddle positions consists of a long call and long put where both options have the same expiration and identical strike prices. We multiply by 100 here because each options contract typically.

Web To construct a straddle you buy 1 XYZ October 40 call for 225 paying 225 225 x 100. Ad Our tools and algorithms help investors design option strategies. Web The Options Calculator is a tool that allows you to calcualte fair value prices and Greeks for any US or Canadian equity or index options contractTheoretical values.

Web A Straddle in Practice. Say that ABC Co. Watch Our Free Webinars Today.

Ad Top Rated Stock Market School. Get a more clear indicator of your performance with benchmark ROAS in your vertical. When buying a straddle.

Web Options straddles and options strangles are remarkably similar strategies. The At-the-Money Straddle Screener enables users to filter and cross-compare at-the-money option straddles from thousands of. Web Let us begin with a Long Straddle.

We expect that something is about to happen with this company but arent sure what. Stock is trading at 50 per share. Both options strategies involve using a call and a put option on the same underlying.

Select your option strategy type Long Strangle or Short Strangle Step 2. The strategy generates a profit if the stock price. Lowest costs for low high frequency options traders.

A realtime options profit calculator that. Enter the underlying asset price and risk free rate. Buying both a call and a put option can help you reduce your overall risk.

Ad Top Rated Stock Market School. Web That translates to roughly a 59 move either way. Ad Real-time implied volatilities greeks scenario analytics and PL impacts.

The Long Straddle is an options strategy involving the purchase of a Call and a Put option with the same strike.

Options Profit Calculator Option Calculator For Canada S Mx Exchange Trade Options

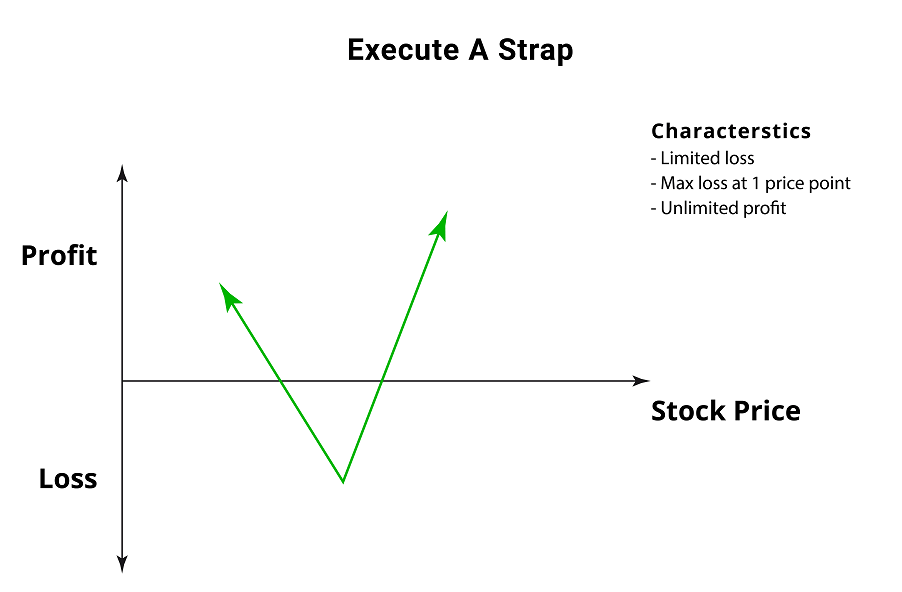

Strap Straddle A Simple Volatile Trading Strategy Suitable For Beginners

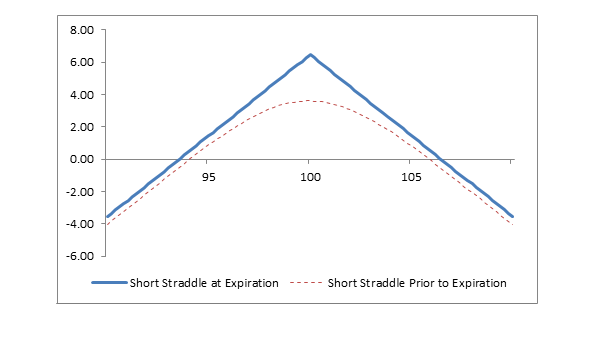

Collect Maximum Income Selling Straddles And Strangles Option Matters

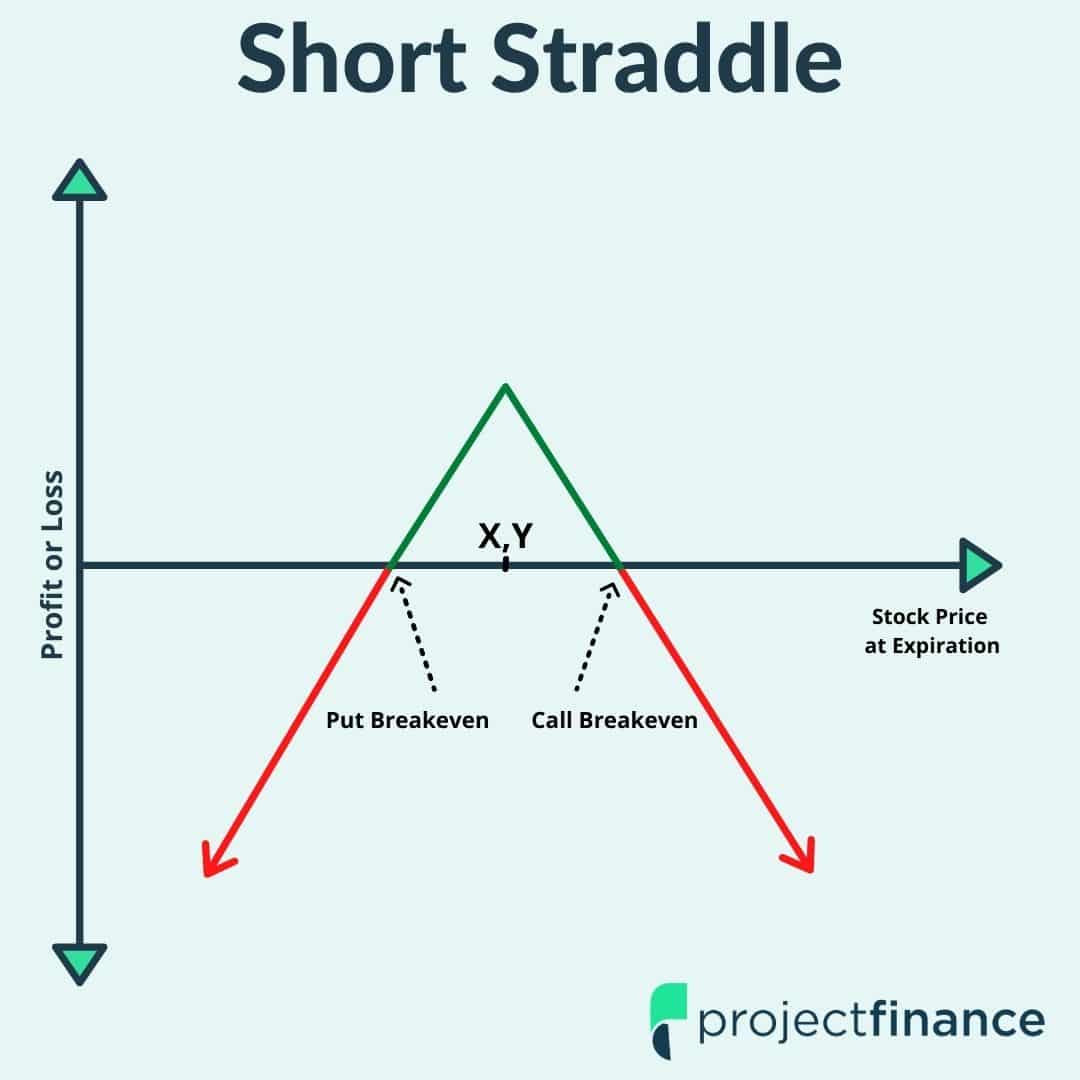

Short Straddle Option Strategy Guide Example

Option Straddle Strategies Trade Options With Me

Spy Short Straddle 45 Dte Options Backtest Spintwig

Long Straddle Option Strategy Guide Example

Short Straddle Fidelity

Calendar Straddle Option Strategy

Option Strategies Long Straddle Excel Template Marketxls

Covered Straddle Explained Online Option Trading Guide

What Is Short Straddle Strategy Explained Angel One

Short Straddle Adjustment Results 11 Year Study Projectfinance

Long Straddle Options Strategy Builder Analyzer Online Optioncreator Com

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_Straddle_Strategy_For_Market_Profits_Jun_2020-02-4f0d46de5d5e4635a47a80a752626d6e.jpg)

Understanding A Straddle Strategy For Market Profits

Long Straddle Payoff Risk And Break Even Points Macroption

Best Options Strategies In 2022 Ig Uk